Micron Technology’s stock (MU.O) has received a rare ‘underweight’ rating from Piper Sandler, reflecting concerns over the company’s significant reliance on consumer markets like mobile devices and PCs, particularly as inflation pressures consumers to cut back on spending. In early trading on Friday, Micron shares fell approximately 6%, trading at $71.18.

In a note to clients, Piper Sandler highlighted, “With the global economy expected to face headwinds, we are concerned about Micron’s more than 50% exposure to consumer-like markets such as PCs, mobile, and other.”

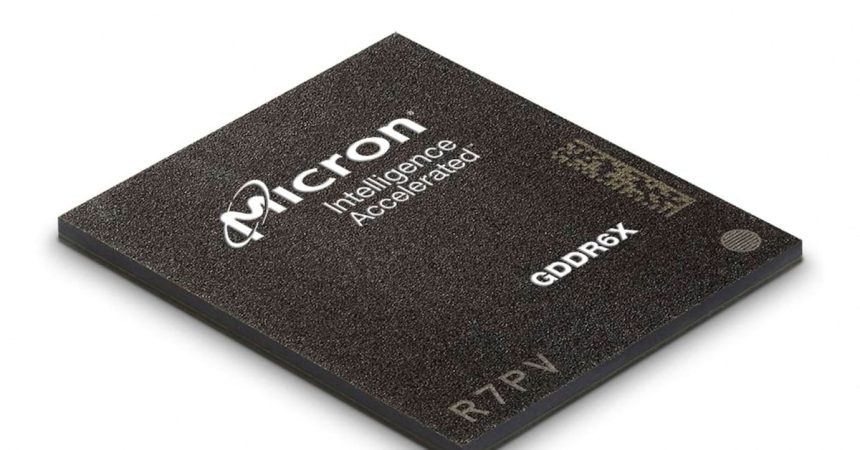

The brokerage also anticipates challenges for Micron’s chip business serving the automotive sector, attributing these issues to rising interest rates, an economic slowdown, and the potential for excess inventory. Additionally, Piper Sandler pointed out that the Dynamic Random Access Memory (DRAM) market, which accounts for over 70% of Micron’s total revenue, has begun to see a drop in prices across various configurations. Micron’s DRAM chips are integral to data centers, personal computers, and a range of other devices.

According to market research firm Counterpoint, global PC shipments decreased by 4.3% in the first quarter of 2022, largely due to the impact of the Ukraine conflict and lockdowns in China that have strained already fragile supply chains and exacerbated component shortages. IDC projects a 3.5% decline in global smartphone shipments this year.

While Piper Sandler commended Micron’s efforts to streamline its cost structure and maintain financial discipline, the firm remains cautious, stating, “we do feel Micron is likely to underperform” because memory products are viewed as largely commodities within the broader market.

On a positive note, the brokerage expressed optimism about Micron’s data center operations, which contribute less than 30% to its revenue. In alignment with its updated outlook, Piper Sandler lowered Micron’s price target by $20 to $70.Laptops